Our strengths

All-in fee

all-in fee of between 0.34% and 0.50% per year, depending on the investment strategy chosen. This amount includes:

the foundation's management fees (0.30%),

external fees (between 0.05% and 0.10% depending on the banking partners),

- internal fund fees (TER of 0% to 0.15% maximum).

No transaction fees, no issue fees, no exchange margins, and no withholding taxes are applied.

Investments

17 investment profiles are divided into three categories :

Global Strategies: 0% to 75% equities,

Sustainable Strategies: 15% to 75% equities incorporating ESG criteria,

Index Strategies: 25% to 80% equities based on Pictet LPP indices.

The portfolio is managed according to a dynamic rebalancing approach with an internal netting mechanism to minimise costs.

Swiss digital platform

Each insured has secured online access to:

check their account value on a daily basis,

change their investment strategy at any time (free of charge),

access their history and documents independently.

In parallel, personalised support is provided!

Vested Benefits UP

Independent and transparent governance

Vested Benefits UP is structured to ensure independent, transparent governance without conflicts of interest. It benefits from the combined experience of FCT and Trianon SA to offer pension solutions tailored to the specific needs of insureds.

Who is Vested Benefits UP intended for?

The vested benefits payment is made whenever an insured leaves a pension fund without immediately joining another one. It applies in particular to the following situations:

- Change of employer

- Parental leave or career break

- Permanent departure from Switzerland

- Unemployment or dismissal

- Becoming self-employed

- Continuing education or retraining

- Divorce or dissolution of partnership

- Granting a full disability pension

- Approaching retirement without new affiliation

In each of these cases, the insured has a legal right to retain their pension assets with a vested benefits institution.

A secure portal

Insureds can access the Vested Benefits UP foundation directly via the secure EBC portal. They can view their personal account at any time to make online transfers.

The "Transfer to Vested Benefits UP " button must be selected. Once the investment strategy has been selected and confirmed, a confirmation is sent.

Overview of UP investment strategies

Three investment categories to meet your objectives

- Global Strategies: 7 investment profiles, from 0% to 75% equities, to build a portfolio tailored to your risk tolerance.

- Sustainable Strategies: 6 sustainable profiles incorporating ESG criteria, from 15% to 75% equities, for responsible investing.

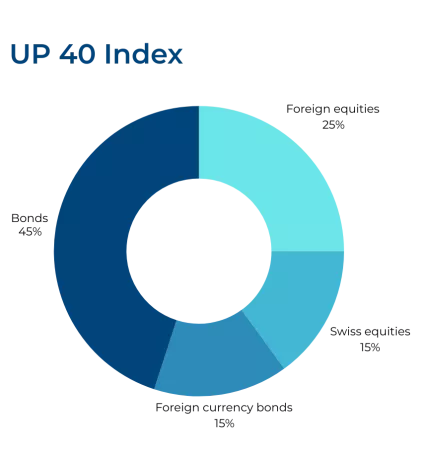

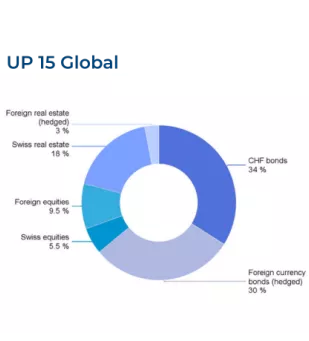

- Index Strategies: 4 index profiles replicating the Pictet LPP indices, ranging from 25% to 80% equities, for simple, transparent, and efficient investing.

Solid performance over time: Our strategies consistently rank in the top quartile of the market over 3 and 5 years, across all categories.